Did you know The Cabbage Patch endowment started after the death of our founder, Louise Marshall, through her estate plan? Today our 79 endowment funds generate almost half of our annual income needed to provide programs for young people and their families.

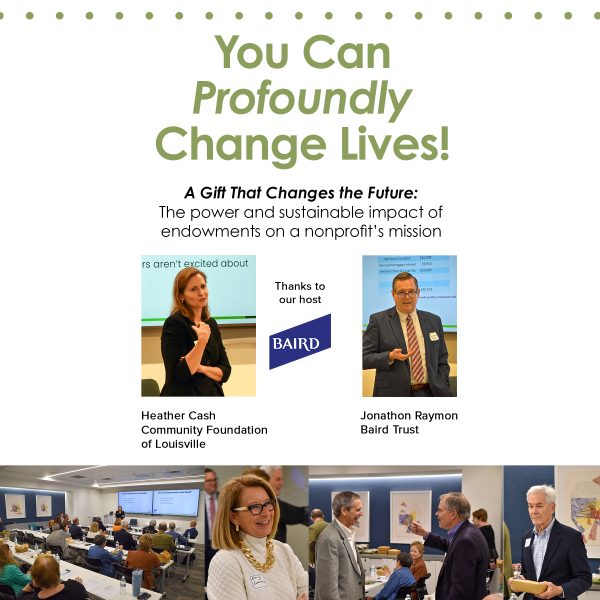

The Patch hosted its first seminar for several donors, and it was a great success. Thanks to our speakers Heather Cash, Community Foundation of Louisville, and Jonathan Raymon, Baird Trust, for sharing their expertise. Heather shared how endowments play an important role in the sustainability of a non-profit and when you make a gift to a charity with an established endowment, you know that your gift will help sustain your favorite charity in perpetuity.

Jonathon shared examples of how donors can make endowment gifts through their current assets or estate plan and showed the best tax advantages for the donor. Did you know giving a gift from your retirement account through your estate plan can save your family on taxes? Since retirement accounts are tax deferred contributions, taxes are due when you take out distributions or through your estate. So, giving charitable gifts using your retirement account and giving gifts to your family with other assets reduces your family’s taxable income.